As the UFC's landmark $1.5 billion broadcasting arrangement with ESPN approaches its conclusion in 2025, the premier mixed martial arts organization finds itself at a pivotal crossroads regarding its media distribution strategy. With ESPN's exclusive negotiation period now officially ended, several major streaming platforms have entered the bidding war, potentially reshaping how fans consume UFC content in the coming years.

Industry sources indicate that Netflix has established itself as the leading candidate to acquire UFC broadcasting rights. The streaming giant brings two significant advantages to the negotiating table: unparalleled global distribution capabilities and a freshly established partnership with WWE through Monday Night Raw — a strategic alignment considering both UFC and WWE operate under the TKO Group Holdings umbrella.

The financial stakes have substantially increased, with UFC reportedly seeking approximately $1 billion annually for its media rights package — representing a nearly 70% increase from ESPN's current payment structure of around $600 million. Netflix's extensive international footprint and substantial resources position it as one of few entities capable of meeting such financial demands while potentially expanding UFC's worldwide audience.

However, experts suggest the organization may pursue a multi-platform approach rather than an exclusive arrangement. Former UFC heavyweight Brendan Schaub recently commented on this possibility, noting: "UFC is going to be all over, but you'll get those Fight Nights - some of those - on Netflix. And don't get it twisted - the UFC is a proven pay-per-view success. They have a business model they would never abandon."

According to Statbet analysis, this fragmenting of sports media rights follows trends seen across major sports leagues, where maximizing revenue through multiple distribution partners has become increasingly common.

ESPN hasn't completely withdrawn from contention, though reports suggest the network remains hesitant to meet UFC's ambitious financial targets. CNBC's Alex Sherman reported that "ESPN still wants UFC rights, but not for the mixed martial arts league's roughly $1 billion per year asking price," potentially creating conditions for rights division among multiple media partners.

Complicating matters further, ESPN is preparing to launch its comprehensive direct-to-consumer streaming platform this fall, offering all ESPN channels bundled with Disney+ and Hulu for $29.99 monthly during its inaugural year — a strategic move that could influence UFC's decision-making process.

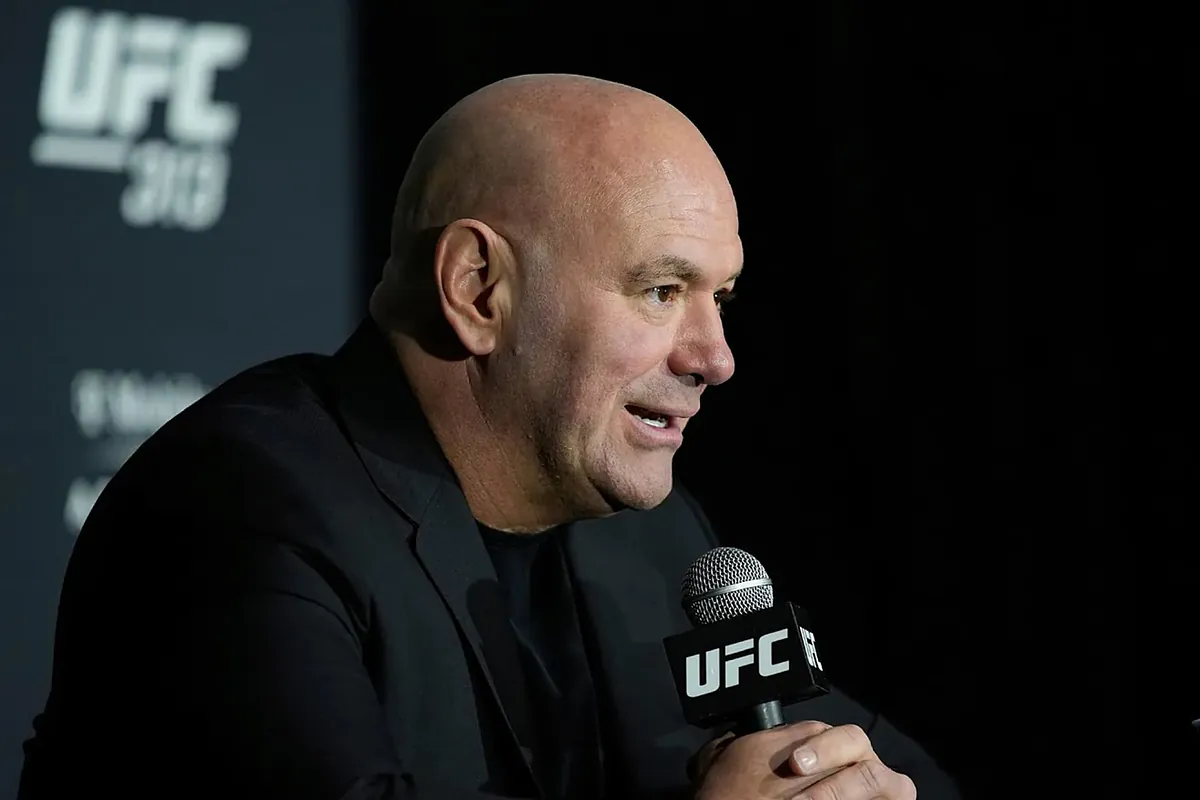

UFC President Dana White has maintained flexibility regarding the promotion's broadcast future, stating: "I don't know. It depends on what ESPN—or wherever else we go—is looking for. Most of the time when you do these deals, you're catering to what the network needs... It always changes. It doesn't matter to me."

The upcoming media rights decision represents a critical juncture for UFC as it balances financial objectives against audience accessibility in an increasingly fragmented streaming landscape.